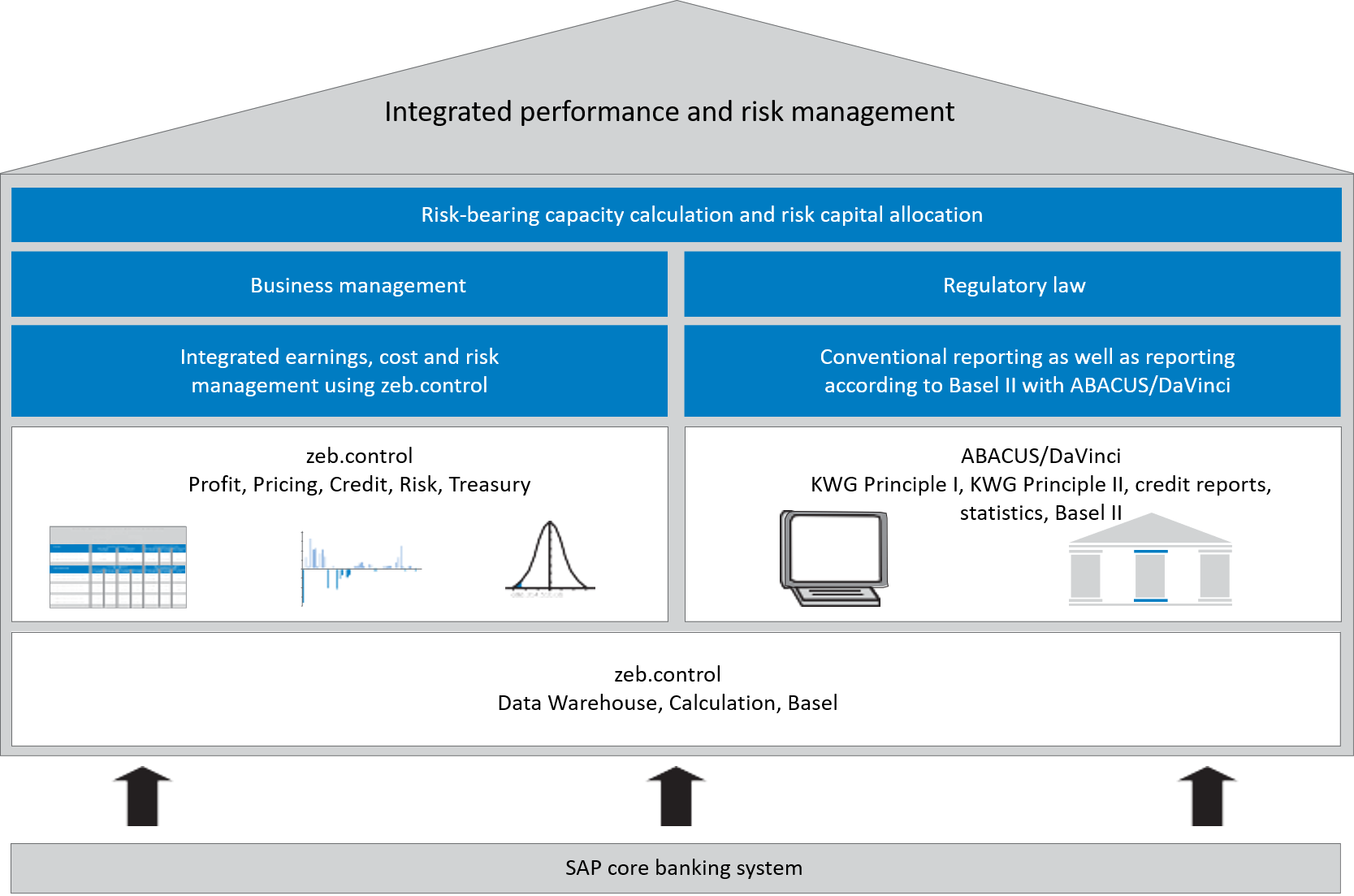

Upon completion of the project, BFS is equipped with standard interfaces of zeb.control - warehouse to the SAP core banking system and the ABACUS/DaVinci reporting software. The implementation of the data warehouse for the entire bank provides an ideal analytical IT infrastructure that fully covers all management and reporting requirements. Furthermore, implementing a Basel II loss database in zeb.control - warehouse fulfills an essential prerequisite for IRB reporting.

After the migration and extension of the zeb.control system software, the following modules can be used for business management and control

- Customer business management

- Credit risk management

- Managing operational risk

- Market risk management in the interest rate portfolio

- Market risk management in trading

Thanks to the implementation of an integrated performance and risk management, BFS is also able to carry out a combined analysis of business and regulatory KPIs. In order to measure the risk situation in the area of credit risk, for example, the unexpected loss calculated using a portfolio model can be compared with the corresponding regulatory Principle I and Basel II figures.

On July 1, 2006, BFS replaced the current core banking system with SAP in a “big bang” implementation and launches the integrated performance and risk management solution. The reporting capability of BFS and thus the functionality of zeb.control - warehouse is an essential prerequisite for the go-live of the new core banking system. Besides the required condition of integrating the reporting system, both the standardized approach and the IRB approach for credit risks as well as the loss database, an important prerequisite for the IRB approach, was implemented in July 2006 and the technical implementation of all submodules of zeb.control is realized. Thus, in mid-2006, BFS had in place all the tools required for a modern integrated performance and risk management.

By introducing the software solution, BFS achieves an excellent strategic positioning that is further underpinned by the system’s flexible extensibility which allows future developments such as the regulatory requirements of IAS/IFRS to be integrated. The implemented solution is thus designed for a period beyond the next decade, which was one of the reasons for deciding on an integrated performance and risk management solution.

en

en