|

LISTEN TO AUDIO VERSION:

|

Step by step guide to an autonomous Treasury

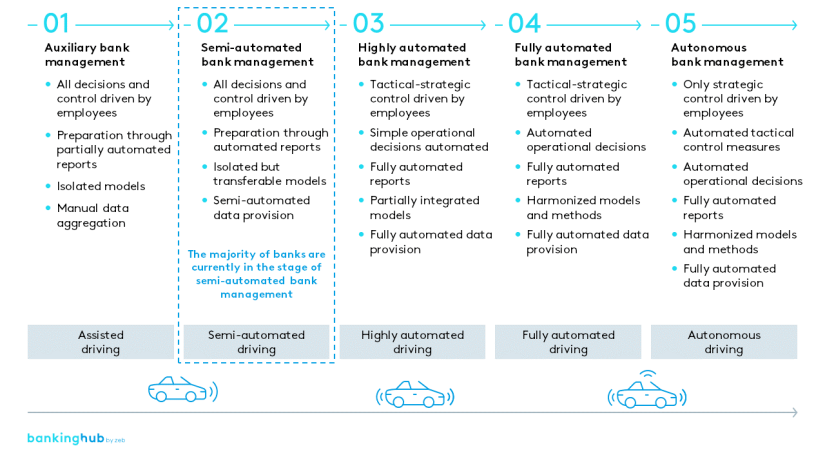

A glance at the development of the autonomous car shows how digitalisation can succeed in Treasury: via a multi-stage development process, which successively transfers more and more activities to machines. The five-stage zeb maturity model for bank management (Fig. 1), which defines autonomous management as the highest degree of maturity, illustrates this process.

Consequently, the role of the Treasurer changes as well: autonomous bank management eliminates the need for human intervention in the form of repetitive, manual activities. Instead, there is a need for the Treasurer to calibrate and validate newly applied models and methods and interpret and communicate results.

Artificial intelligence will not substitute human intelligence when it comes to the strategic interpretation of a large number of individual results of various simulations. In an autonomous Treasury, the Treasurer and Treasury staff increasingly assume the role of critical advisor and sparring partner of the CFO. They are able to quickly analyse scenarios and strategic options for action-taking thanks to a digital and intelligent infrastructure.

Use Cases in Treasury: Technology as a Means to an End

In contrast to customer business, where the customer’s experience is often the priority, use cases in bank management are not immediately obvious. This is because there is not only one interface between customers and front-end applications, but a multitude of interconnections and interdependencies between data and systems.

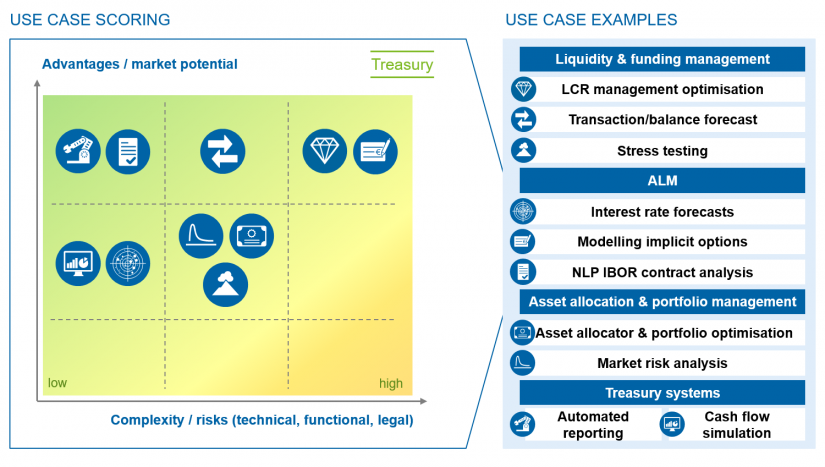

In a use case matrix (Fig. 2), which is by no means exhaustive, zeb evaluated some bank use cases in terms of benefit vs complexity. However, this only provides a general first impression. Benefits vary greatly depending on the existing processes, data situation, and business model of the bank in question. Together we can identify and analyse the institution’s problems and, based on this, select the appropriate technology for the desired solution. Depending on the use case, this can be a tried and tested tool or an innovative digital method.

There are numerous areas of application within the Treasury department, ranging from liquidity and funding management, asset allocation and portfolio management to ALM and governance. This article presents only a brief selection.

Use Case: Optimisation of LCR Management and Customer Behaviour Modelling with AI in Treasury

The high levels of liquid assets held by banks have had a massive negative impact on the profitability of European institutions for years. The problem has become even more acute in conjunction with the negative interest rates in the EUR and CHF currency zones. If forecasts lack sufficient quality, banks tend to hold larger reserves of highly liquid assets, which has a negative impact on the profitability of their own investment portfolios.

A very interesting use case for this scenario is the AI-assisted forecast of cash flow and inventory. An improved forecast can be achieved in several ways. For example, by modelling implicit options using machine learning algorithms that can process large amounts of account, customer and market data to predict future customer behavior (e.g. terminations, prepayments, withdrawals of variable deposits) per individual customer more accurately.

A more global approach to the topic is to use customer and business data at the individual account level or even at transaction level to model all LCR-relevant products. This involves, for example, screening the transactions on a customer’s current account for recurring patterns in order to improve forecast accuracy. The more accurate the forecast, the less liquidity buffer institutions require. This means that they can invest the released liquidity in higher-yielding[1] assets.

Use Case: Automating Reporting and BAU in Treasury

Due to, in many cases, fragmented data and system landscapes, employees have to collect a large amount of data manually each day and prepare it independently. Such activities tie up a great deal of resources, are error-prone, and slow down decision-making.

Institutions that still operate in this manner could greatly reduce their employees’ workload with automated reporting or the preparation of daily exposure calculations, e.g. by using robotics. This not only saves costs, but more importantly, frees up time for essential tasks.

Use Case: Faster Cash Flow Simulations in the Cloud

Cloud technology enables mass data processing at speed. For example, the cash flow simulation of a large number of accounts with interest and repayment data currently takes several hours, and is a large undertaking usually only carried out overnight.

If these tasks were broken down and run in parallel with an Elastic MapReduce (EMR) cluster using cloud resources, calculation time could be reduced to a matter of minutes. This would allow several calculations (and recalculations) to be carried out in one day and thus enable exploratory work.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Challenges in Treasury with Growing Digitalisation

The digital transformation in bank management is complicated by the fact that banks operate in a very sensitive area and methods used must stand up not only to management but also to regulatory scrutiny. Depending on the technology’s complexity, justifiable questions arise regarding transparency of the methods used and the explainability of potential results.

Although different scientific approaches[2] have been developed, so far they have shed little light on black-box algorithms. At best, they reveal only vague insights. Depending on the specific use case, banks must therefore carefully consider (possibly in consultation with the supervisory authority) which method is most appropriate to balance forecast accuracy with transparency/explainability and also manageability.

As a rule, banks should pay special attention to security and data protection. In the first step, both in the selection of the technical methodology and in the selection of data, they must make sure only to use data fields that are essential to the analysis (privacy by design or privacy by default), and, if necessary, consistently pseudonymise or anonymise personal data. Again, depending on the use case, they must decide which measures are necessary.

The regulatory authorities are already taking a close look at cloud computing. BaFin, for example, published guidance on outsourcing to cloud providers as early as 2018, and the Swiss Bankers Association followed suit in 2019 with cloud guidelines. In the UK, the FCA updated such guidelines in 2019 and the same year the Bank of England also commissioned a special research report on Future of Finance with findings and recommendations. When processing and storing data in cloud resources, banks need to classify this as outsourcing and consider security issues accordingly. Cloud providers offer comprehensive security standards for this purpose, validated by ISO and other certificates. They also grant audit rights required for financial regulatory authorities and for the institutions.

All challenges are detailed in the analysis of each use case. Whenever innovative technologies offer clear advantages in terms of quality, efficiency or risks, it is worth tackling the hurdles mentioned above.

Agile Approach Quickly Shows Potential

In order to overcome these challenges, and at the same time to successfully implement the use cases, it is necessary to consistently combine methodological and practical expertise. zeb ensures this is achieved by forming a joint team of people with the respective institution. These interdisciplinary teams of data scientists, AI and Treasury experts, who contribute their in-depth understanding of Treasury processes, not only facilitate knowledge transfer right from the start, but also provide an initial insight into the potential of digital technology at low resource cost. In addition, an agile approach allows for quick adaptation to the individual needs of the respective institution. In particular, using the “fail fast” principle (if a method does not achieve its intended goal or does not work, this becomes clear very quickly) the procedure can be adjusted easily.

Prototyping is a repetitive, multi-stage process. At the beginning of the process, and thus at the first stage, we always jointly identify an institution-specific use case. In a status-quo analysis, we begin this phase by developing a common understanding of both the data and models currently in use and by verifying the data available. An interdisciplinary team develops hypotheses on possible factors influencing the model.

During the implementation phase, we select suitable methods and algorithms and prepare relevant data. This is done taking into account digital resources and proven frameworks, so as to significantly enhance the digital skills of the bank departments involved and provide an in-depth insight into the pros and cons of different technologies and approaches.

The third phase of joint prototyping involves presenting the results achieved and detailed discussion on how to use them. This allows us to assess the potential for implementing a more extensive use case, which in turn forms the basis of any decision with regards to a further project.

Conclusion: AI and Digital Technologies in Treasury

New innovative, digital methods provide banks with a variety of new instruments. However, it is better not to focus on the technologies themselves, but on the common challenges that a bank’s Treasury faces every day. Depending on the use case, we can then use the method that best solves the bank’s problem. This could be by using new digital technology, but also by using the traditional range of statistical methods or a combination of both.

By adopting an agile approach, the bank’s Treasury function can follow the prototypical development of new models closely or pilot processes and learn new methods. Thus, the Treasurer and Treasury staff successively grow into a new understanding of their role and can allocate freed-up resources to new, essential tasks (e.g. the interpretation of future-driven simulations).