Chartis Vendor Landscape Credit Risk

14.01.2020

CHARTIS VENDOR LANDSCAPE: ZEB.CONTROL IS A COMPREHENSIVE "ENTERPRISE SOLUTION" FOR RISK MANAGEMENT

Chartis Research, the leading development and analysis provider of risk technology in the global marketplace, recently released its Vendor Landscape report on credit risk management. The report placed zeb.control prominently in the banking book by recognizing it as a functionally comprehensive risk management solution. The placement within the Vendor Quadrant proves that zeb.control is able to provide end-to-end capabilities as well as offering customers the opportunity to purchase a full-featured risk ecosystem.

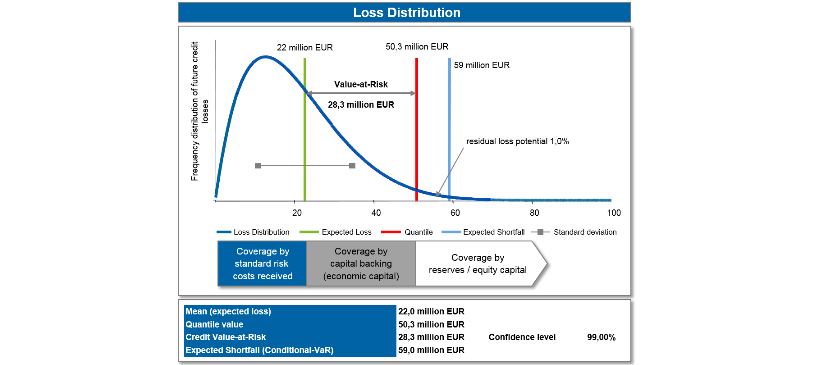

Figure 1: Loss distribution

Chartis described the zeb.control software as a functionally rich management platform for its flexibility and openness in the market under consideration. Furthermore, the comprehensive service capabilities of its risk module were recognized. The effective risk management software zeb.control.risk enables an active management of all relevant risks of a bank, including market price, liquidity, credit and operational risk. In addition, all functionalities are optimally tailored to the needs of the customers.

In addition, zeb.control.risk is able to perform analyses and simulations on a group and bank-wide level, ranging from flexibly definable portfolios to individual positions or transactions and offering drill-down functionality. The software supports a wide range of scenarios that allow the comprehensive simulation of market developments and activities at the portfolio level.

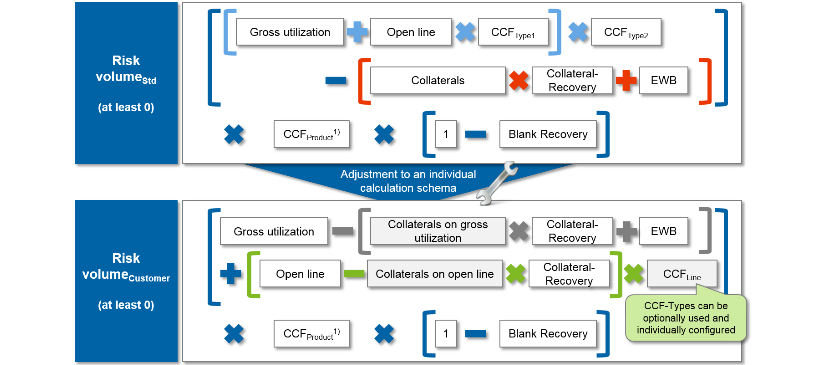

Figure 2: Risk volume

In addition to its risk management capabilities, the zeb.control.risk software enables data management, which makes it valuable for customers as an optimal one-stop solution. zeb adapts the functionalities to the customer's needs, offers functional and technical assistance in setting up a risk management system from a single source and provides individualized support from the outset. To this end, zeb develops the required database, ensures the optimal adaptation of the portfolio model to the customer's needs and supports the integration of value at risk in bank-wide management.