New version of zeb.control ALM

10.03.2020

THE NEW VERSION OF ZEB.CONTROL - ALM IS HERE!

The focus of the functional enhancement of the new version of ALM is on supervisory requirements and the integration of experience from the LSI stress test. In this context, the software benefits from the upgrade from 4.18 to 4.20 with various functional enhancements:

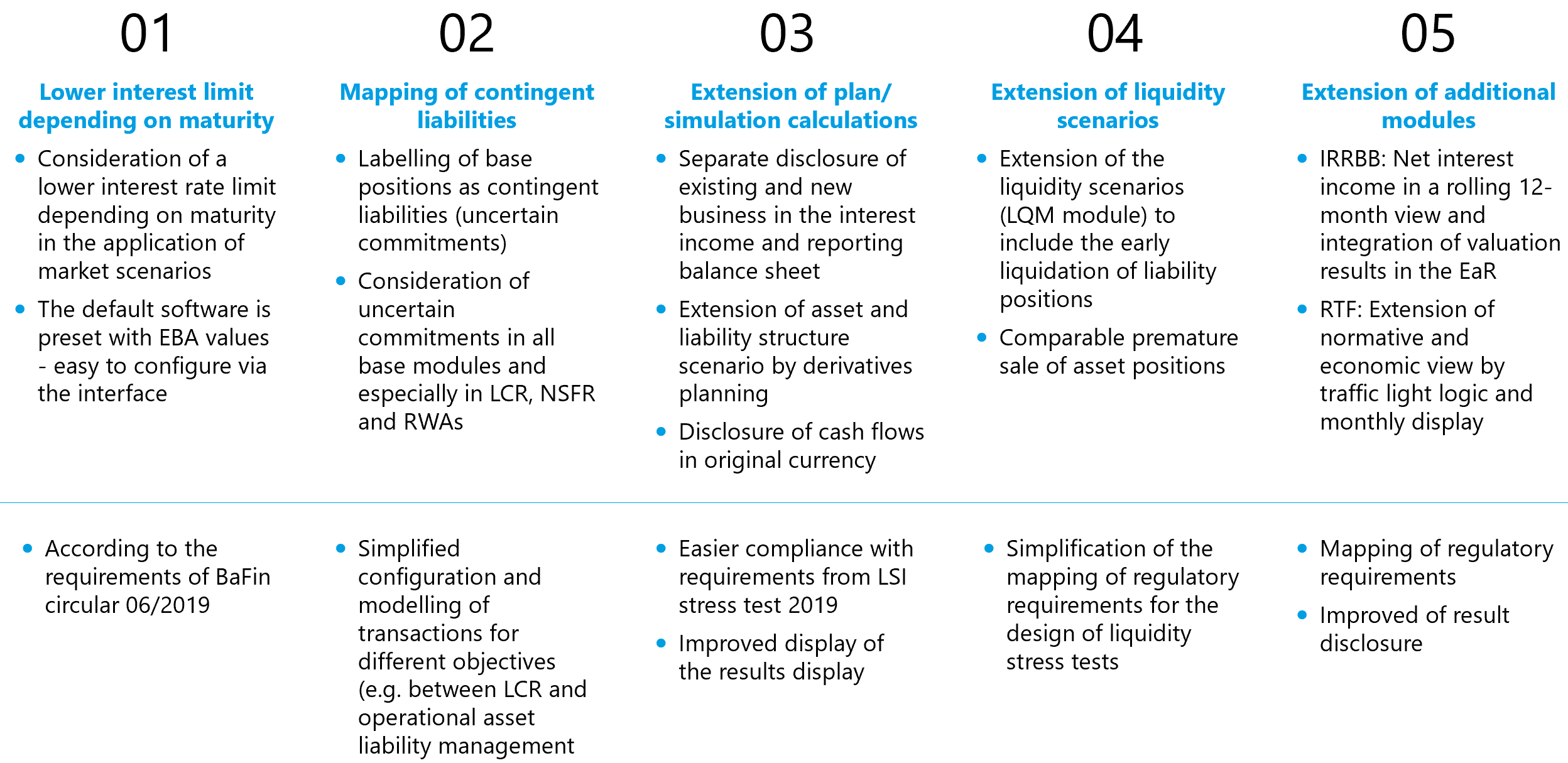

In accordance with the requirements of the BaFin circular on interest rate risk in the banking book (06/2019), a dynamic interest rate floor is required. Therefore, a maturity-dependent interest rate floor was taken into account in the new release of ALM when applying market scenarios. In the standard delivery, this was preset with EBA values, which can be easily configured via the interface.

As a result of the upgrade, it is now possible to map contingent liabilities in all base modules and in particular in LCR, NSFR and RWAs, which means that base positions can be flagged as open commitments. This results in a simplified configuration and modeling of transactions for different objectives such as between LCR and operational balance sheet structure planning.

In addition, planning and simulation calculations have been extended. This includes, on the one hand, the separate reporting of existing and new business in the interest income and reporting date balance sheets and, on the other hand, the balance sheet structure scenario has been extended to include derivatives planning. In addition, the release allows cash flows to be reported in the original currency. These enhancements make it easier to meet requirements from the 2019 LSI stress test and improve the presentation of the earnings statement.

Another objective was to simplify the mapping of regulatory requirements for the design of liquidity stress tests. This was made possible by extending the liquidity scenarios with the LQM module to include the early liquidation of liability positions.

Furthermore, additional modules were added to the ALM software. Firstly, the IRRBB module has been added, which maps regulatory requirements in a rolling 12-month view and integrates valuation results into the EaR. On the other hand, the normative and economic view of RTF is extended by the traffic light logic and monthly presentation, which significantly improves the presentation of the earnings statement.

For further information or questions regarding zeb.contro, please contact us!