Integrated risk/return management

Deutsche Bausparkasse Badenia AG, based in Karlsruhe, is part of the Generali Deutschland group and has been one of the major private building societies in Germany for many years.

Deutsche Bausparkasse Badenia AG, based in Karlsruhe, is part of the Generali Deutschland group and has been one of the major private building societies in Germany for many years.

With a view to further improving their internal management, Badenia has launched a project to establish an integrated risk/return management system. The core elements of the new system were to include the value-based splitting of all profit components of the overall bank performance, the management of market, interest rate and liquidity risk and the implementation of a revolving building-saving multi-year planning in an integrated system. Following an extensive software selection process, zeb was chosen as the partner for the implementation thanks to its flexible zeb.control solution.

In the first phase of the project, the preliminary study, we detailed the business contents based on the requirements specification drawn up by Badenia and checked how they could be met by the zeb.control modules. In the course of joint project planning, we evaluated and scheduled the tasks at hand.

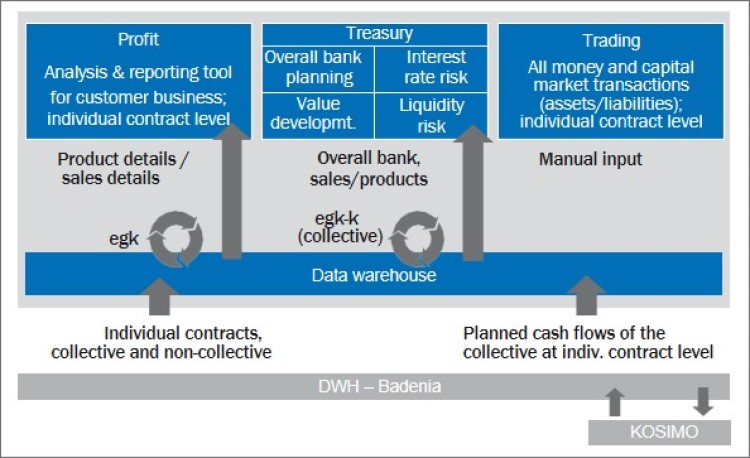

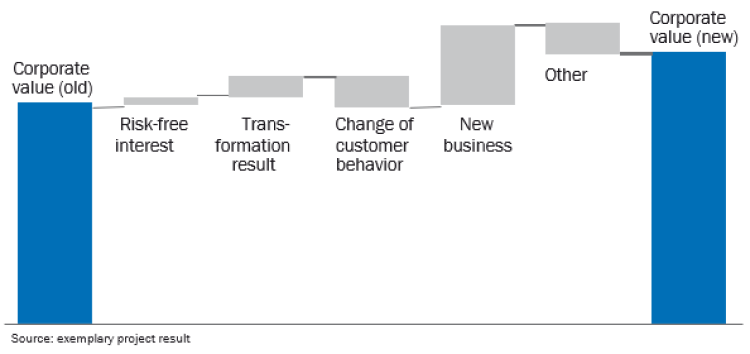

The first implementation phase focused on the data integration of the individual zeb.control modules into Badenia’s existing architectural landscape. In this phase we also tested Badenia’s new management concept, which involves a present-value splitting of profit components at overall bank level. This test already enabled a transparent analysis of the causes of corporate value changes.

The next project phase initially focused on mapping and managing the main risk types with the corresponding risk modules. The main priority was interest rate risk. In the next step, we realized a planning solution which was exactly tailored to Badenia’s requirements and which incorporated the results of the collective simulation as well as the contribution margins of the non-collective business. The Excel-based planning solution, which had previously been implemented with numerous interfaces, could thus be fully converted into a largely automated software solution for multi-year revolving overall bank planning.

During the next phase, the methods and procedures developed at overall bank level were transferred to the individual contract level. For this purpose, in addition to the non-collective business, the collective business was also calculated in detail, based on the expected individual contract cash flows supplied by the collective simulation program KOSIMO. The change in present value for different tariffs and distribution channels can thus be analyzed both from an ex-post perspective and a future perspective. In addition to considering the corporate value change, analyses of the contribution margin can be carried out for the individual distribution channels and products on the basis of the profit contribution margin calculated for individual contracts. The solution realized so far provides Badenia with a management platform for an integrated risk/return management. In particular, the detailed analysis of corporate value changes on different levels of observation, which we elaborated in collaboration with Badenia, represents a substantial further development.

In the next phase, we will complement the system set up to date with an integrated risk-bearing capacity management system. This will ensure consistent internal and regulatory management in the future. A preliminary study for the implementation of the IRB approach based on the zeb.control platform is currently in progress in order to continue the successful joint project work.