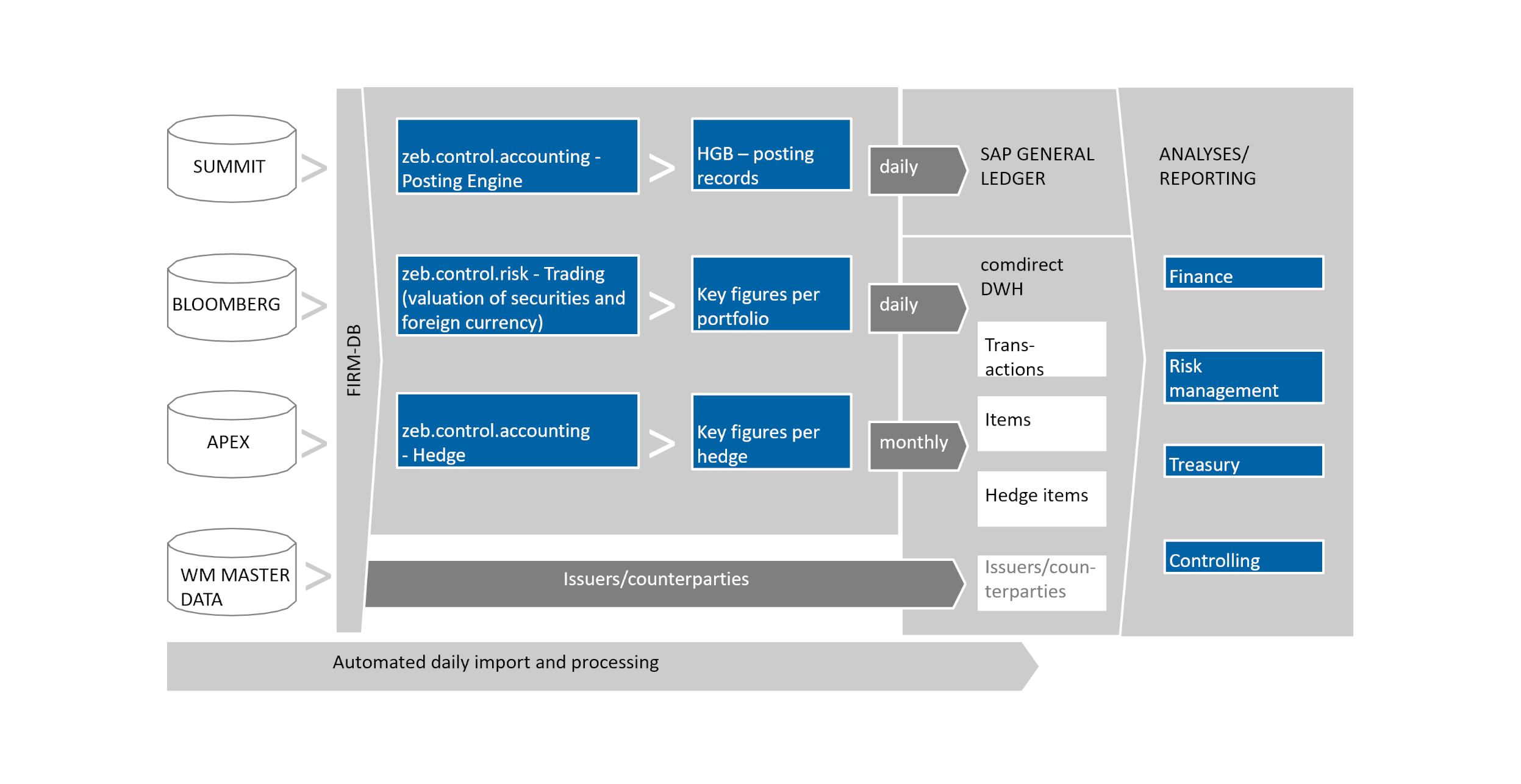

To begin with, we clarified comdirect’s requirements in workshops and, on this basis, derived the range of necessary functionalities. As a result, we developed a solution comprising the three modules zeb.control.risk - Trading, zeb.control.accounting - Hedge and zeb.control.accounting - PostingEngine. The modules required further development in order to include the posting logic according to HGB as well as securities lending transactions.

comdirect supplied the data required for valuation/measurement by setting up an input interface. This interface automatically supplies the master, transaction and market data in accordance with the standardized mapping rules of the Trading module. The data is then processed internally at zeb, providing the Hedge module and the posting engine with all the relevant information. In order to also store the data from the zeb modules in the comdirect data warehouse, interfaces were set up that allow for information to be transferred via the database. For posting HGB business transactions in SAP, the system also generates an RFBIBL file as part of the daily process, which is then transferred to the SAP general ledger.

All processes (e.g. for the data import and export) were set up by means of zeb.control’s job management in such a way that the job scheduling software used by comdirect can automatically call up batches. This enables the bank’s IT operations to carry out daily processes in a simple and convenient manner.

Following the technical installation of the three software modules, we carried out the specific configuration together with comdirect. In the Trading module, this involved defining portfolios and creating reports, whereas in the Hedge module it included creating hedge configurations and building a portfolio hierarchy. For correct posting in SAP, account mapping was defined in the posting engine, taking into account not only general parameters of a business transaction but also comdirect-specific parameters per transaction.