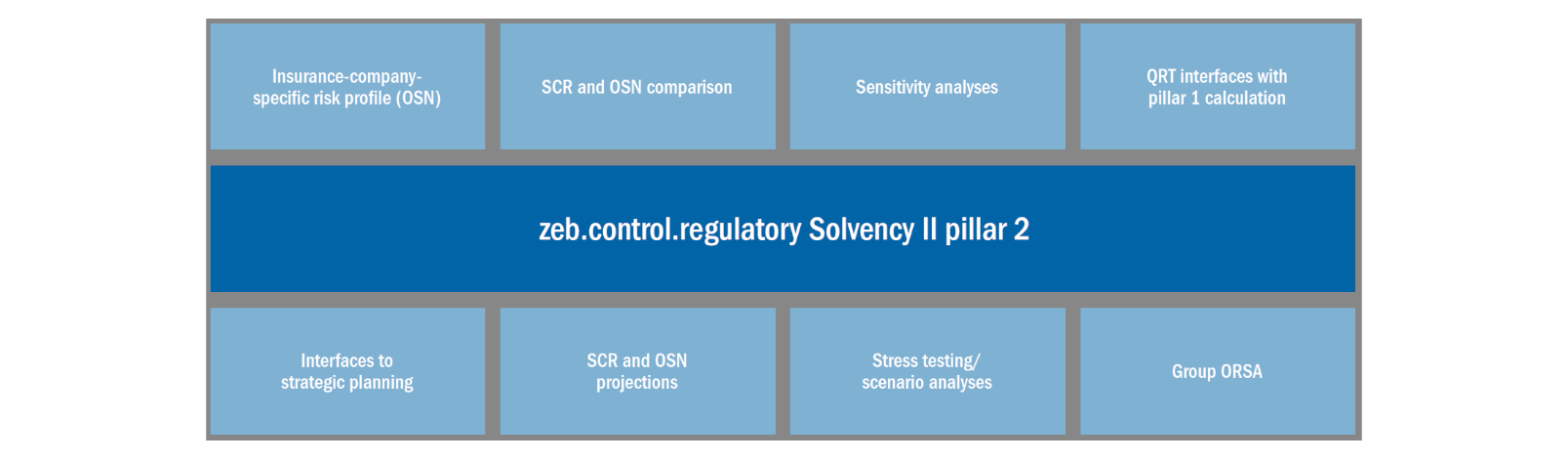

Implementation of Solvency II with zeb.control

Grazer Wechselseitige Versicherung (GRAWE Group) is an Austrian insurance company with a long-standing tradition. The group has around 4,500 employees in 14 Central and Eastern European countries. As the sixth-largest insurance company in Austria, it unites countries and people as well as banks and insurances to form a close network. GRAWE Group set up a project to make sure that Solvency II requirements were implemented for nine insurance companies (solo) subject to reporting obligation according to EU law. The group process also included nine other insurance subsidiaries from non-EU countries, a banking group and a real estate holding company.