Margin calculation in a zero interest environment

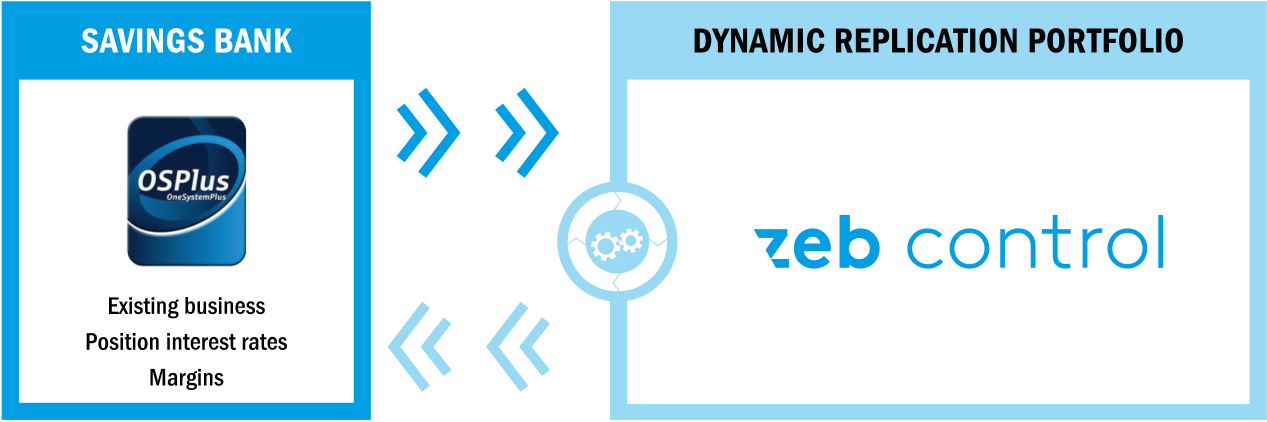

For Stadtsparkasse Düsseldorf, customer deposits without a contractually fixed interest rate represent a key source of funding. These especially include the money market accounts commonly referred to as “instant access savings accounts”, traditional savings deposits, but also transaction accounts for retail and business customers. In light of the financial crisis and zero interest rate environment, the institution has seen significant inflows especially in the area of money market and transaction accounts. The existing calculation model, however, has not proven to be responsive enough: without a correction mechanism which considers the effect of volume inflows on the current (low) level of interest rates, there will be incorrect results in determining margin contributions and thus the splitting of the net interest income of the overall bank. To avoid generating the wrong management stimuli, Stadtsparkasse Düsseldorf thus decided to expand its internal management systems. In a joint project with zeb, the concept of a dynamic replication portfolio was implemented based on a corresponding module from the zeb.control product family.