The Avaloq Banking Suite provides an integrated MIS add-on module with extensive controlling functionalities, which is based on the zeb.control information system that allows the wealth management provider to lay the technical foundation for effective and efficient management decisions. In detail, the main advantages of the MIS are:

- proven standard reportings that contain sales controlling key figures, trend identifications, the possibility of drill-down functions and customized reports

- flexible and fast ad-hoc analyses with a pivot functionality from a strategic management-based view of profitability down to the profitability of a single customer or account

- full integration into the Avaloq Banking Suite

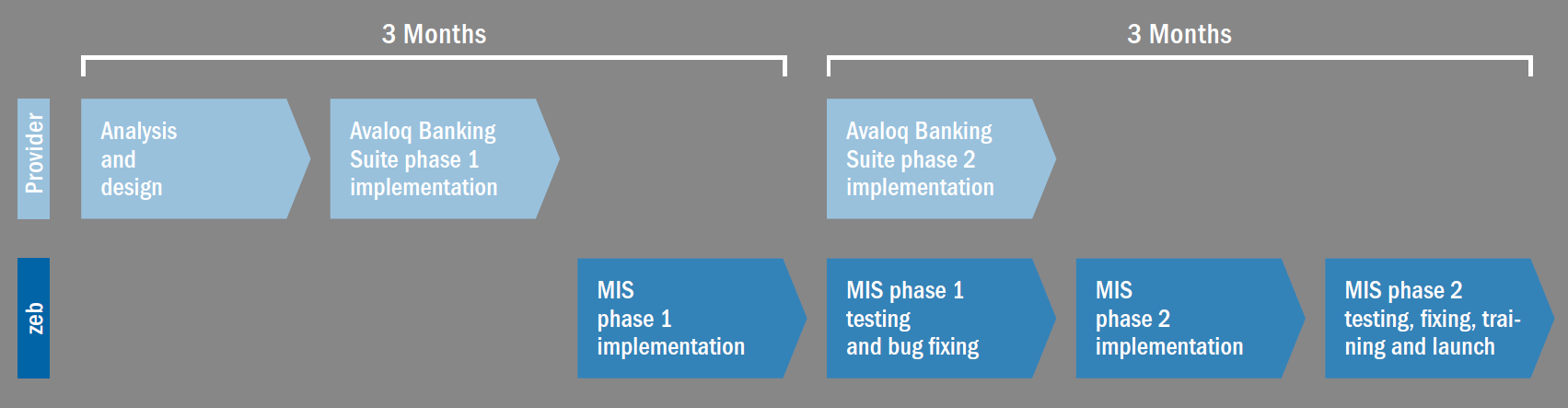

On top of these, the basic package of the Avaloq MIS add-on module allows for further individual enhancements. A few months before the launch of the Avaloq Banking Suite, the project started with a kick-off workshop that defined the required MIS scope. The scope was aligned to the basic MIS offering, while additional requirements were phased separately. Subsequently, a project plan was set up with the fully defined scope and divided into two phases. The first phase included the implementation of basic functionalities and small parts of the additional requirements (i.e. those that were necessary for the first phase implementation). In the second phase, all remaining requirements were implemented.

The first project phase started with the analysis and design phase. Under the main responsibility of the wealth management provider and with the support of Avaloq, the provider defined the required business definitions, e.g. for net new money and MIS structures. With the implementation of the Avaloq MIS add-on module into the Avaloq Banking Suite, its quality gates (as laid down in the parameterization guidelines) were fulfilled and so the actual MIS implementation could start. Subsequently, under the main responsibility of zeb, the first MIS implementation phase began with customizing the data transformations and setting up reporting hierarchies (e.g. cost centers, service types). After the implementation, the project passed into a phase of testing and bug fixing. In parallel, the provider and Avaloq defined the requirements for phase two. Due to this approach, there was no need to interrupt the MIS implementation at any time. In phase two of the MIS implementation, zeb finalized the additional requirements regarding calculation and reporting. In addition, a quality assurance phase with extensive testing started again. Afterwards the MIS was ready for launch. In parallel, the users were trained to build additional management reports by themselves. Based on a clearly defined scope and implementation approach, the project took only six months from its kickoff to the launch of the Avaloq MIS add-on module.