In a first step, we specified the business requirements for implementing market risk management (interest rate and currency) and liquidity risk management, which can be derived from regulatory requirements (MaRisk, Basel II/III, EBA guidelines, etc.), but also the requirements from GEFA’s internal management and those specific to the group. Subsequently, we compared GEFA’s existing feeder systems with the business data requirements, defined the necessary data fields and processes and ensured the automated integration of all relevant feeder systems.

For the technical implementation of the ALM system in zeb.control, we jointly developed a modular target architecture. In this context, GEFA attached great importance to the implementation of both zeb.control - ALM management software and an application that enables rule-based detection and audit-proof correction of data quality problems (data quality management). Furthermore, the ALM architecture provides interest and liquidity cash flows for single transactions of GEFA and product aggregates. This enables higher-level analyses both for various units within the GEFA group and for individual account-related data requirements for interest and liquidity reporting at group level.

In addition to present value interest risk management, which characterizes GEFA’s current management philosophy, we implemented a multi-period, P&L-oriented perspective for the interest rate portfolio. For this purpose, we created ALM scenarios for the development of customer business conditions and market interest rates and coordinated the planning of the balance sheet structure with the controlling department. In addition, we defined liquidity spreads based on direct and indirect liquidity costs and set up a transformation result balance sheet. This makes it possible to include GEFA-specific liquidity costs both ex ante and ex post in the margin calculation.

In addition, a clear delimitation of the periodic net interest spread and transformation results ensures transparency of the effects of the interest and liquidity maturity transformation on net interest income.

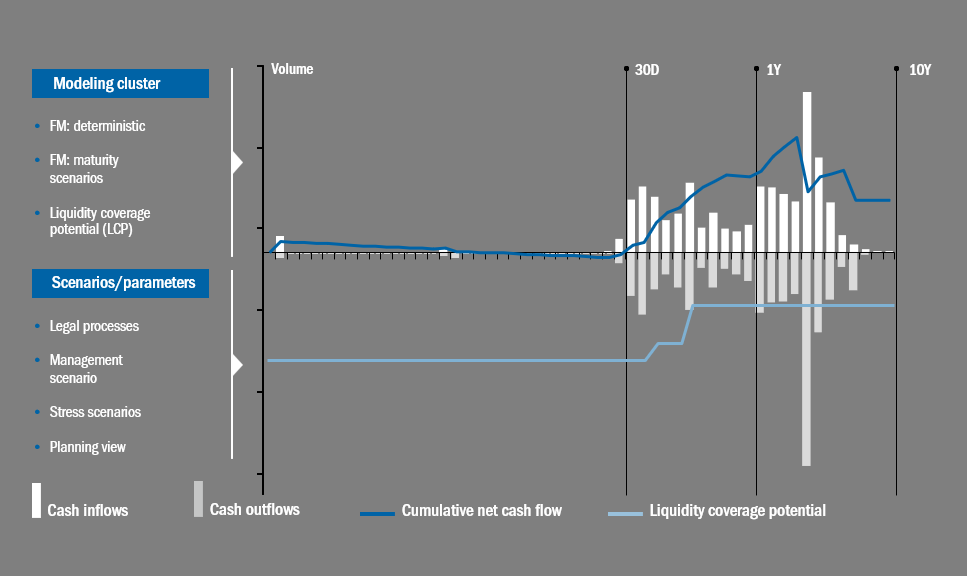

For GEFA’s liquidity risk management, we implemented appropriate liquidity overviews and, based on these, developed detailed management and stress scenarios (see Fig. 1). In order to ensure a management basis in line with the capital commitment, we first specified the items relevant for the funding matrix and the liquidity coverage potential. Based on this GEFA-specific management scenario, we then developed a limit concept. In addition to the “survival period” required by the regulatory authorities, this concept includes additional deductions from the liquidity coverage potential to ensure GEFA’s solvency in the short and long term. We developed additional stress tests to gain an even more detailed insight into potential liquidity risks.

en

en